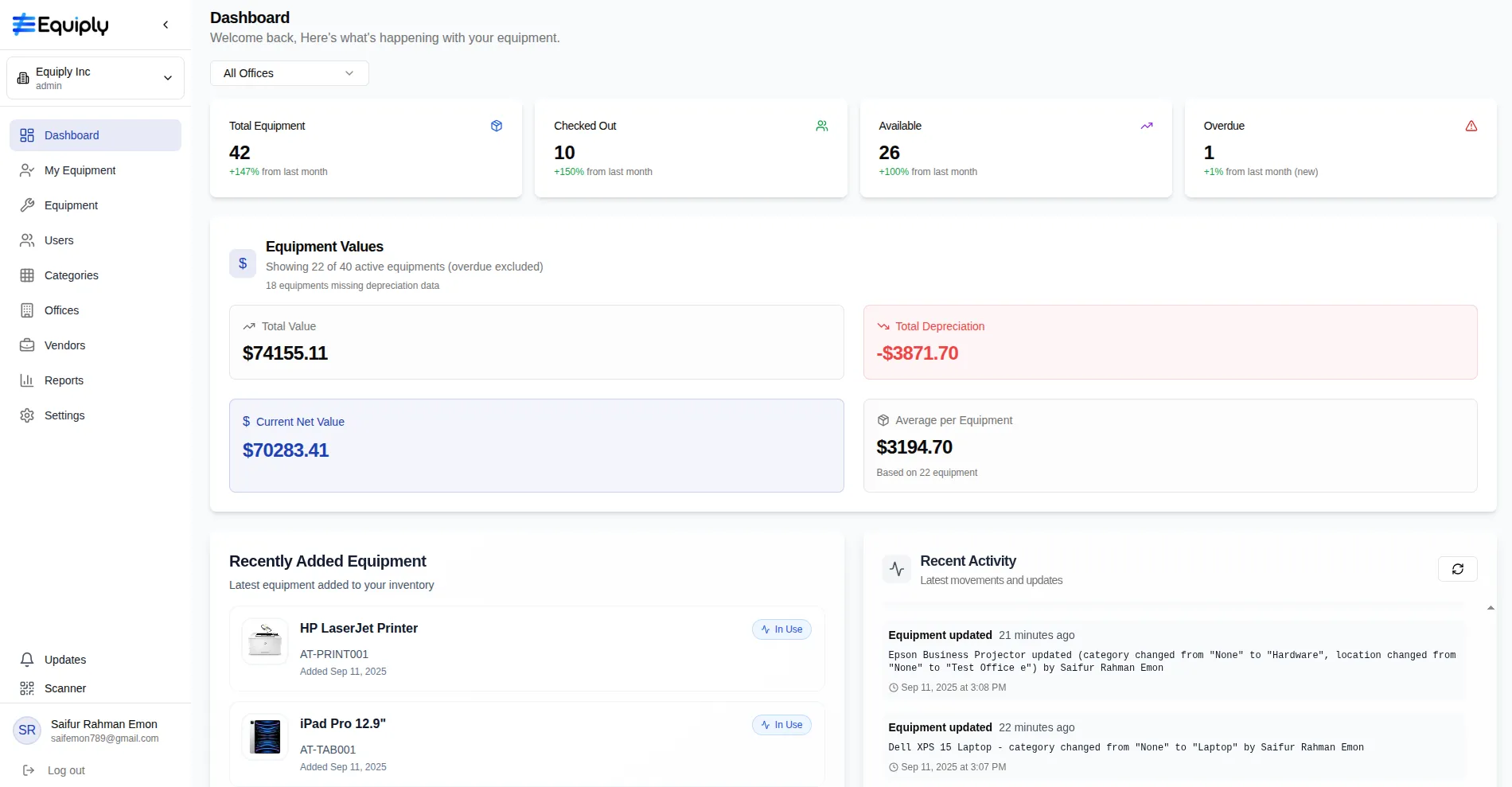

Automated Equipment value calculation

Track equipment depreciation automatically with multiple calculation methods and generate accurate financial reports.

Comprehensive depreciation management

Multiple calculation methods, automatic updates, and detailed reporting for accurate financial planning

Multiple Methods

Choose from straight-line, declining balance, or custom depreciation methods

- Straight-line method

- Declining balance

- Custom formulas

- Method comparison

Automatic Updates

Equipment values update automatically based on your chosen depreciation schedule

- Daily calculations

- Scheduled updates

- Real-time values

- Historical tracking

Financial Reports

Generate detailed depreciation reports for accounting and tax purposes

- Tax-ready reports

- Audit trails

- Export options

- Custom periods

Depreciation methods supported

Straight-Line Method

Equal depreciation amount each year over the equipment's useful life

Declining Balance Method

Higher depreciation in early years, decreasing over time

Units of Production

Depreciation based on actual usage or production output

Custom Methods

Create your own depreciation formulas for specific equipment types

Accurate financial planning

Make informed decisions about equipment replacement, budgeting, and financial reporting with precise depreciation tracking.

Tax Compliance

Generate tax-ready depreciation schedules and reports

Replacement Planning

Plan equipment replacements based on depreciation schedules

Budget Accuracy

Improve budget planning with accurate equipment valuations

Equipment Portfolio Value

Start Managing Your Equipment Smarter Today

Join hundreds of teams using Equiply to save time, cut costs, and stay audit-ready.

No Credit Card Required!!!!